Over the last year, I interviewed many CEOs of various international companies, large and small, profit and nonprofit, grownups, and scaleups in all sorts of industries. The leading question was always: “How do you organize your innovation most effectively?” The discussions were confidential, and content was often competitive and market sensitive. The results are short anonymous corporate stories. Honest and insightful. A great way to share knowledge and innovation experience.

The ecosystem in food/agriculture

An interview with the CEO of Startlife, the incubator/accelerator of Wageningen University

The incubator/accelerator

Last year we celebrated our 10th Anniversary. Startlife is an Accelerator and Incubator all in one. We are situated on the University campus with 2000m2 of dedicated office space. In 2010 we originated from a project stimulating entrepreneurship. It focused on venture building of spin-offs from the University of Wageningen using mainly public funding. Our focus is, not surprisingly, on Food and Agriculture and is science-based. This means that ventures should really be new and or disruptive. To explain this a little bit for your readers we are not looking for the next meat substitute.

In 2013 our program went national. And in 2018 Startlife became international with a strong focus on Europe.

Foundation

Startlife has a couple of strong pillars:

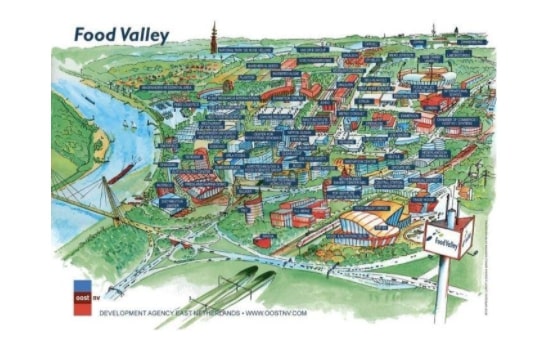

- The Food Valley Ecosystem. A campus with a lot of R&D departments of all major food manufacturers in Europe

- A network of around 10 multinationals in food/agriculture that perform reality checks, supply mentors and coaches, facilities, and investments.

- And finally, the powerhouse of the international University of Wageningen, since 1876 specialized in life sciences and agriculture. Ranked number one in the world in the fields of plant/animal science, environment/ecology, and agriculture.

Financially there is (limited) budget of €500K a year. Corporates are asked a yearly fee to participate on a three-year contract. There is also a pre-seed Fund available of €6 M. The fund gives soft loan convertibles of €100K. An independent review board awards the money.

How does it work?

Every year, two cohorts of 10 ventures are allowed in the Startlife ecosystem. Every cohort has around 75 applicants. During selection days they are brought back to a desired 8-10 participants. Every year you will find around a total of 45 ventures actively participating in the ecosystem. No upfront stock/equity is required to participate.

We also have no full-time residency. The teams come from all over Europe and often need access to clients or suppliers’ premises to further experiment. During the accelerator program the teams participate 3×1 full week on site in the program. However, they are allowed to stay on site for the whole program if they like.

What is the difference with large corporate innovation hubs?

We often get this question. There are some good examples of open innovation/incubators from large corporates. For instance, Unilever’s The Foundry in the UK and their other innovation hubs like Level3 in Asia and the Dogpatch labs in Ireland. Or another good example is Nutreco’s NuFrontiers incubator program.

The basic difference with The Foundry and many other corporate programs is that they tend to be more market(ing) driven. Startlife focuses more on R&D (an early phase) and has an open innovation mantra. Nutreco’s NuFrontiers is an exception to the rule. They participate (together with Leonardo DiCaprio) also in more typical moonshot projects like the cultured meat producer Mosa Meat.

The food/agriculture ecosystem

Food Valley consists of +3.000 agri-food related companies and institutes. We give shelter to +15.000 experts with 110 nationalities and are the home of several R&D centers of major companies like Unilever, FrieslandCampina, Kraft Heinz, Givaudan, and Nestlé. But regarding the ecosystem the conclusion is that we are not there yet. There are many research consortia also with European and or national funding. Corporates work together but (still) on an exclusive basis. There is not a lot of pre-competitive research. It is more application-based. The EIT (European Institute of Innovation & Technology) also hosts many programs (e.g. health, food, digital,…) in which Billions of Euro’s are spent. Each program hosts around 50 entities, of which 10 universities, 15 corporates, etc. But again, no competitors are allowed.

Our position in the ecosystem

The University of Wageningen has always ranked the number 1 institute on food/agriculture. They have been very good at knowledge transfer. The institute consists of two entities. 50% is the University and the other half is the contract research unit. The latter having very close ties with the corporate world linking it to the scientific world. One of their greatest achievements is the biyearly Potato demo day. A place where farmers, traders, producers, and many other companies that have anything to do with potatoes meet & greet and are invited by Wageningen University & Research. Over 25.000 participants meet from all over the world to hear and see the latest in potatoes.

Competition is outflanking us

But commercially Wageningen has fallen behind competition. Wageningen people are ‘do-gooders’ and lack a certain entrepreneurial drive. Israel is beating us in our game. What is the secret of their success? Four discriminative factors play a role. For one they feel more urgency to innovate. Their natural habitat is mostly dessert, and they are surrounded by enemies. Food is a crucial factor for survival. Second, all Israelis go into military service for a couple of years. Boys and girls. This drills youngsters and brainwashes them for the good. Working together is key for survival, and skills learned during Army time are essential for later successful startup culture. Third, the Israeli government has always supported innovation for many decades. There is a lot of money involved. Startup Nation Central is a good example of this. They even sponsor a team in the Tour de France. And fourth the ecosystem in Israel works very well. There is a great sense of togetherness.

Future challenges

Besides competition, we face a lot of future challenges in food. Think about the circular economy, sustainability (carbon oxide a.o.), new technologies, and increased awareness of healthy nutrition of consumers. And food is just plain difficult in startup country.

We are competing in the startup scene not only with Israel. There is a huge difference between the US and Europe. In the US valuations have developed out of any realistic proportion. Fortunately, there is more in this world than money can buy. But it is of course not supporting our position in Europe.

We are now looking to expand our program with specific themes and dedicated corporate sponsors. Programs with more private funding and international partners like Startup Nation Central. A second area is around corporate spinouts. To create specific programs, working methods, and approaches for corporate venturing outside the company.

The next step for Startlife will be to develop a serious Seed fund of around €12M. Smart money from the ecosystem.

The ‘how to’ topic accrued out of the feedback that we got from readers of the book I have written on innovation with my esteemed colleague Matthijs Rosman called ‘DARE, The Mindset for Successful Innovators in the Digital Age’.

The purpose of the interviews is to create a new publication as successor of DARE. Do you want to join the conversation? Feel free to contact me at eric@revelx.nl.

Eric de Groot

Boardroom strategist with unparalleled creative brainpower. Always focused on growth. Creates speed by combining business modeling with inventive pragmatic solutions. Invests in involvement over a sustained period.

Related posts

Manual vs AI-powered subsidies search: A novel approach to public funding

Ever felt like finding the right subsidy feels like…

November 20, 2024

How to Prevent Innovation Theatre

Learn how real innovation drives success and avoid the…

June 21, 2024

Corporate Innovation: A Catalyst for Success

In the dynamic and competitive business landscape,…

June 7, 2024